Daily OFW Financial Guide – April 5, 2025

Day 1: How to Secure Your Future by Building an Emergency Fund

As an OFW, you work hard to provide for your family, but what happens when the unexpected strikes? Whether it’s a medical emergency, job loss, or an unexpected expense, being prepared financially is key to maintaining stability. That’s why we’re launching the Daily OFW Financial Guide—to equip you with the tools, tips, and information you need to make smart financial decisions.

Today, we kick things off with the most important step to securing your financial future: building an emergency fund.

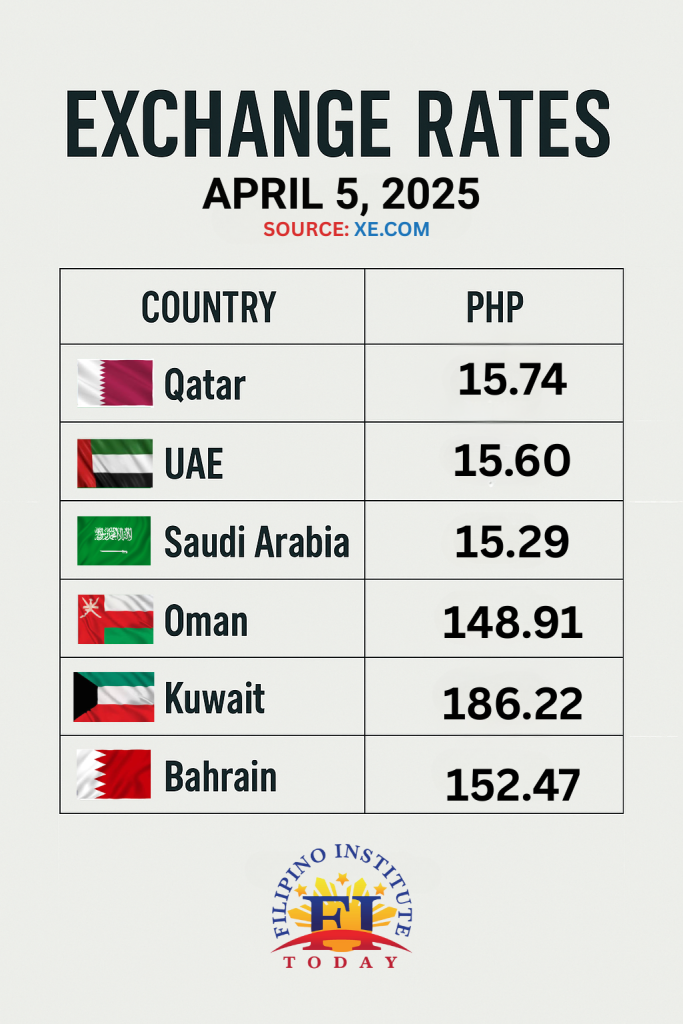

🌍 Exchange Rate Update – April 5, 2025

Here’s a snapshot of today’s exchange rates for OFWs working in the Middle East:

💡 Day 1 Tip: How to Secure Your Future by Building an Emergency Fund

Why It Matters:

Life can throw curveballs, but by building an emergency fund, you’re making sure that when challenges arise, you can handle them without added stress. This financial cushion will also allow you to keep supporting your family back home, no matter what happens.

How to Start Building Your Emergency Fund:

- Set a Clear Goal: Aim to save 3 to 6 months’ worth of living expenses.

- Start Small: Even saving a small amount every month will add up over time.

- Use a Separate Account: Make your emergency fund separate from your regular spending account so it’s not tempting to dip into it.

Stay Tuned for More Daily Tips!

We’ll be posting a new tip every day to help you better manage your finances while working abroad. Make sure to check back tomorrow for more actionable tips and updates.

Join the Filipino Institute Circle

Want more in-depth financial tips and advice? Join the Filipino Institute Circle today to get access to exclusive resources, tools, and financial education to help you succeed on your financial journey.